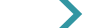

operating in

uncertain times

A REGIONAL ANALYSIS OF CLAIMS AND DISPUTE CAUSATION

Major capital projects are highly complex, as is the web of forces and failures that lead to costly delays, overruns and conflicts. Not only is that project complexity increasing, but contracts are also exposed to heightened uncertainty arising from the global coronavirus pandemic and its aftermath.

CRUX Insight 2021 identifies and analyses the principal causes of claims and disputes.

CRUX Insight distills expert analysis of actual problems encountered on more than 1,400 projects across 94 countries.

442

projects

18

countries

$1.08bn

average CAPEX value

$61.5m

average value claimed

61.2%

average EOT claimed

32

projects

15

countries

$1.87bn

average CAPEX value

$104m

average value claimed

83.7%

average EOT claimed

329

projects

12

countries

$1.98bn

average CAPEX value

$134m

average value claimed

84.7%

average EOT claimed

93

projects

21

countries

$6.43bn

average CAPEX value

$93.5m

average value claimed

64.4%

average EOT claimed

122

projects

4

countries

$3.52bn

average CAPEX value

$90.3m

average value claimed

78.1%

average EOT claimed

383

projects

24

countries

$689m

average CAPEX value

$136m

average value claimed

64.0%

average EOT claimed

COVID has unilaterally stalled the movement of people and goods within and between regions, slowed production of materials and products, altered conditions for workers, imposed new constraints, and negatively impacted the industry’s productivity. Employers and contractors are experiencing increased project delays and disruption, cost overruns, and divergence from business case estimates.

Over the last decade, many international organisations delivering capital projects have come to rely on highly mobile personnel and labour. This trend was enabled by cheaper travel, legislative environments allowing freedom of movement, and expansion of recruitment and supply channels across and between continents.

The pandemic, along with international variations in vaccination levels and requirements, has raised barriers. High demand is also exposing scarcity in human resources, particularly in developed economies where the construction and engineering industry is unable to attract sufficient new blood to replenish its ageing workforce.

To drive efficiency and eliminate waste, many organisations have adopted lean production principles, such as Total Quality Management, and just-in-time logistics, whose successful operation is dependent on the use of complex, international supply chains. Operating in this way not only requires investment in supporting systems,

but also intensive planning and scheduling, and detailed awareness of strategic risk. Before the pandemic, the prospect of such a shock to the global economy and capital project ecosystem was not on the risk management radar or catered for in standard forms or bespoke construction contracts.

One positive impact of the COVID crisis has been the accelerated adoption of digital communications and technologies. This has not only enabled remote working but has afforded projects access to a wider talent pool, with a potentially global reach for certain skills. Digital models, drones, robotics, virtual / augmented reality, and other advanced systems have also found new advocates and applications in a traditionally conservative industry.

However, most of the benefits from technology have been seen in management, planning and design, modelling and professional services.

Other parts of the construction process have slowed the pace of project delivery due to bottlenecks in logistics, stock, sequencing, and on-site labour. Also, the use of BIM is often not sufficiently comprehensive, understood or supported to realise its full potential. The lagging productivity of the construction and engineering industry is largely due to sluggish adoption of technology and resistance to change.

Many Governments see investment in infrastructure as a viable method of stimulating their economies. As well as the short-term benefits in trading activity and jobs, there are longerterm gains in terms of connectivity, business productivity, community services, revenue streams, and asset portfolios with enhanced environmental performance. However, a bow wave of largescale projects being let to the market requires careful management, execution, and integration with other developments if value for money is to be achieved. This combination of well-planned activity and a properly structured pipeline – that can be relied on by the supply chain – is essential to ensure that demand can be met without overstretching the industry or overheating the market.

From Germany and Belgium to Australia, and from North America to India, flash floods, forest fires and other extreme weather events have borne out the increasingly stark warnings of the international scientific community. The increase in gas and oil prices is forcing companies and organisations of all sorts to recalibrate their energy budgets and usage. Pressure is increasing for government and regulatory intervention to promote sustainability in all sectors, not least construction and the built environment.

– George Bernard Shaw

CRUX can answer a multitude of questions posed by clients – such as how project outcomes vary by contract type; the proportion of disputes settled in particular jurisdictions; typical dispute values on different types of renewable or fossil energy projects; or the length of time extensions sought on infrastructure projects by region.

This intelligence can help clients to:

Having analysed the drivers of claims and disputes in their regions, our consultants outline practicable measures and interventions aimed at reducing the persistently heavy burden of cost and time overruns on projects.

The growing use of Dispute Adjudication Boards and arbitrations is improving how disputes are managed and resolved. A similar maturing of the claims culture is overdue. The industry can learn the lessons of other regions by adopting best-practice protocols for delay and disruption and forensic schedule analysis.

Employers should adhere to their contracts rather than allowing local deviations when processing claims. Contractors can ease their serious payment problems and build more robust claims by keeping comprehensive records. To assess and resolve large, complex claims within the contractual timeframe, both sides need to engage expert claims specialists sooner, while upskilling their own teams.

Many major projects are suffering unintended consequences from the push by owners / employers to design at pace, and rush to mobilise construction contracts, compounded by acute skills and materials shortages. Many of our recommendations entail a more proactive approach to anticipate and alleviate resultant problems.

Risks should be managed up front by getting the parties together to review the contract, drawings, and schedule, flushing out issues before work starts on site. More employers and contractors also need to conduct risk analyses and be certain as to which party will own and mitigate risks.

To combat a rash of design failures, scope needs to be more clearly defined and designs frozen at an agreed stage. Checks on design progress should be maintained during construction and constructability reviewed by the contractor, with provision for the designer to adjust the price according to the revisions required.

In Asia, risk management practices could be adopted with greater frequency. The use of Risk Registers would help risks gauged during pre-construction and allocated to ‘risk owners’ early are cheaper to mitigate. Linked to project controls, a register’s underlying assumptions are tested and adjusted during construction. Operational failures commonly seen after handover can also be pre-empted.

A culture change is needed to streamline the handling of claims and defuse disputes. Formal independent avenues to resolution are not popular. A costeffective alternative would be a standing committee of specialists, representing both contracting parties, with the necessary knowledge and authority to decide commercial, technical and contractual matters, agree on concessions, and settle claims and disputes before they escalate.

Design errors have overtaken change in scope at the top of the region’s causation ranking. Employers, contractors and design consultants are wasting time and resources debating potential claims without a rigorous assessment of the technical grounds. Appointing an independent expert at an early stage – as more owners and their legal teams are now doing – helps all parties to understand exactly what went wrong and why, and to avoid full-blown and costly disputes.

A clear and logical handling process would also facilitate earlier settlement of claims overall – at 58.3% of total project CAPEX, the highest of the regional averages. Ideally developed jointly with the supply chain, this process needs to set out the obligations on both sides, along with timescales for submissions, decisions, and progression from site to senior levels before referral to a final dispute forum. Enacting the processes enshrined in the contract when parties are on good terms is also advised.

Projects are subject to longer extension of time claims (equivalent to 84.7% of the schedule, on average) than in any other region. Pending more systemic change, tentative trends – more resources committed to design development, early contractor involvement (ECI), and thirdparty determination of disputes – are to be encouraged.

ECI should cover design development, aligning this with a robust schedule, and agreeing on risk allocation and ownership. More employers also need to stress-test buildability, as is far more common in other regions.

Investing more in people – including training and development of high-calibre professionals – will improve project governance and attract a new generation who can foster cultural change in project delivery.

The construction booms in New Zealand and Australia (where current and planned infrastructure investment is unprecedented) raise exciting yet daunting prospects. A paradigm shift is needed to prepare the capital projects ecosystem for looming challenges in contracting capacity, skills and the supply chain.

At a macro level, Australia’s A$110 billion pipeline is a once-in-a-generation opportunity to build construction and engineering capacity, and leave a lasting, sustainable legacy of skilled employment, prosperity, and environmental improvements. Infrastructure plans should be reviewed by independent experts to provide a robust, deliverable programme, coordinated and phased as part of a national capacity building and employment strategy.

At project level, standard contract forms (such as NEC) and key performance indicators that foster collaboration can pave the way for a culture change. Partnership charters – committing parties to work to an agreed set of principles and outcomes – are also conducive to this new way of working.